Public Investment Fund

-

Public Investment Fund

The Public Investment Fund is the sovereign wealth fund of the Kingdom of Saudi Arabia.

The fund was established in 1971 and is considered one of the largest sovereign wealth funds in the world.

The fund occupies the eighth place, with total assets estimated at about $390 billion,

and is specialized in financing projects of strategic value to the Saudi national economy.

The Kingdom of Saudi Arabia aims to transform the Public Investment Fund into one of the largest sovereign funds in the worldk

by working to build a diversified and pioneering investment portfolio by investing in attractive investment opportunities at the local and international levels.

The Public Investment Fund managed $400 billion in assets in 2020.

-

The fund Portfolio

The fund has a portfolio of about 200 investments, of which about 20 are listed in the Saudi Stock Exchange.

The Public Investment Fund seeks to become one of the largest sovereign funds in the world.

by building a diversified and pioneering investment portfolio by investing in attractive opportunities at the local and international levels.

The Public Investment Fund has been a pioneering economic tributary and a contributor to the development of many entities for more than (46) years,

as it contributed to establishing a number of major companies in the Kingdom since it was established in 1971 by Royal Decree No. (M / 24).

It also contributed over the years to financing and participating in many vital projects and companies,

by providing financial support to projects of strategic importance to the national economy.

A qualitative leap occurred in the fund’s march in 2015 after the issuance of a decision by the cabinet to link the fund with the Council for Economic and Development Affairs,

and then reconfigure the board of directors to become headed by the Saudi Crown Prince, Prince Muhammad bin Salman bin Abdulaziz Al Saud.

This step was considered very important, as it granted the Fund more general powers, assigned it to more comprehensive tasks,

and assigned it to strategic national responsibilities that were more present and more precise.

The Fund’s role in the economic field has grown at an accelerated and creative pace in light of the broad strategies approved by the Council of Economic and Development Affairs,

in the context of the efforts made to advance the national economic transformation and sustainable positive change in the Kingdom.

-

The Five Pivotal Pillars of the Public Investment Fund

- Launching and developing local sectors by maximizing the value of the fund’s investments in Saudi companies,

through establishing and developing sectors, diversifying sources of revenue, taking advantage of resource potentials and improving the quality of life. - Investing in priority sectors, mainly: aviation and defense, vehicles, transport and logistics,

food and agriculture, building and construction materials and services, service facilities and renewable energy, minerals and mining, health care,

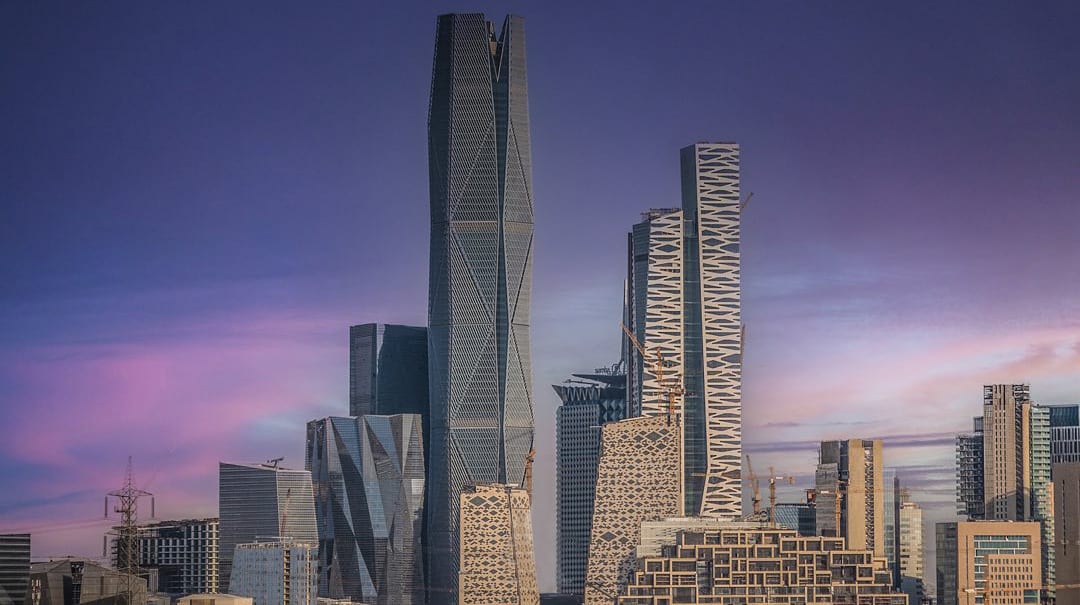

financial services, entertainment, tourism and sports, real estate, communications and media. And technology, right down to consumer goods and retail. - The development of real estate projects locally and the target is to raise home ownership in the country to 70%,

and to improve the basic infrastructure of the Kingdom and the best practices in building and construction in accordance with international standards,

given the consequent promotion of it as a tourist destination as well as diversifying sources of returns and improving the experience of pilgrims and Umrah for local visitors. And internationals. - Promote the Kingdom as a global tourist destination, and focus on major projects in the Kingdom,

through which it enables the creation of new systems and the launch of new sectors that depend heavily on technology and knowledge.

You May Like: Panel materials .. use, types and method of storage