Architecture and the Economy: Inside China’s Ghost Cities

Architizer is thrilled to announce the winners of the 11th Annual A+Awards! Interested in participating next season? Sign up for key information about the 12th Annual A+Awards, set to launch this fall.

Susan Sontag once said that there were only three subjects she had been interested in her whole life: “freaks,” women and China. She isn’t alone — especially on that last point. The world’s oldest continuous civilization has always captivated Westerners, partly due to the perception that it is shrouded in secrecy.

Even fifty years after Nixon visited China, this perception still has some basis. The political regime of President Xi is not known for its transparency. While China is by no means a hermit kingdom, there is much about its economy, military and politics that remains the subject of speculation. Little details, anecdotes or photographs from China are scoured like Rorschach tests, with Western spectators seeing in them what they want to see: evidence of either China’s strength or its weakness, its national virtue or its deep corruption. And as fear of China’s rising power has grown, these interpretations have trended toward the ominous.

In recent months, as rumors of China’s economic crisis have spread, the images that seem to interest people the most are photographs of China’s so-called “ghost cities” — urban developments that are eerily under-occupied. The most famous of these, the city of Ordos in Inner Mongolia, is also one of the most captivating, as it includes not only luxury residences but also city squares and museums. But what do these images signify? Are Ordos and similar developments simply modern-day Potemkin villages designed by the CCP to place a veneer of luxury on an economy with deeply flawed fundamentals? The answer seems to be yes and no.

According to experts, China’s economic crisis is driven by an over-reliance on investment as opposed to consumer spending as the driver of economic growth. As counterintuitive as it might sound to those who, like me, never got past Econ 101, economic growth can be driven by capital investment even when there is a lack of demand for the products and services that are being invested in. Stephen Morgan, a professor emeritus of Chinese economic history at the University of Nottingham, explained this process in a recent interview with Vox.

“Investment is largely going into, as I said, infrastructure, real estate. At present, probably about 40 percent of that is unproductive,” explains Professor Morgan. “One way to think of that is ‘bridges to nowhere.’ The thing about investment is it doesn’t matter whether the bridge goes to nowhere or it actually serves a purpose. It produces GDP growth.When I was living in China, between 2013 and 2020, in Ningbo, I used to take the bus to work every day. The bus stops between my apartment and the university were rebuilt three times — three times in about six years. The first time they needed rebuilding. The second time, there were some nice improvements, like electronic boards that told you when the bus was going to come. The third time they rebuilt all the bus stops with so much steel you would need a tank to knock them down. Other than that, there was very little welfare benefit. That’s wasted investment.”

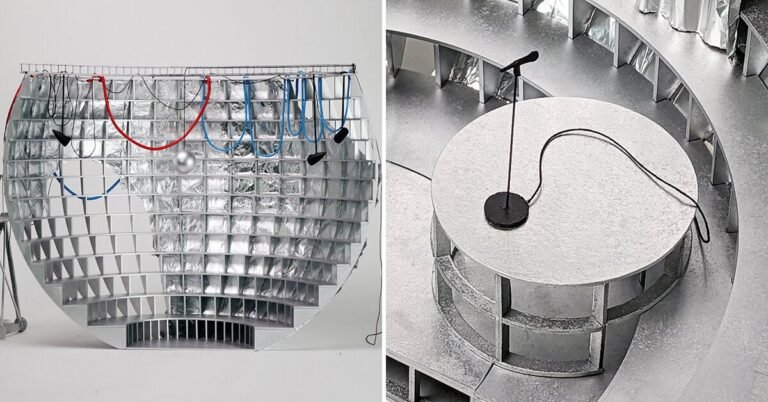

The city of Ordos isn’t exactly empty, but it feels that way. Over two thirds of its apartments are unoccupied. Image: Popolon, architects : Ma Yansong, Yosuke Hayano, Dang Qun from MAD Architects[1], Ordos Museum, CC BY-SA 4.0

Real estate was long considered a “safe” investment, which is why the Chinese state encouraged and participated in this kind of investment. Some are still holding out, sitting on empty properties hoping they will get a return. However, the situation is strikingly unbalanced. According to a 2021 Business Insider article, there are about 65 million empty homes in China, almost enough to house the entire population of France. This is an especially daunting statistic when one considers the fact that many people in China live in substandard housing. The real estate that is being built is not being utilized by the Chinese population.

So what do the Chinese ghost cities signify? Nothing more or less than the misallocation of resources in that country. It is a problem created by a set of policies that solved one problem (increasing economic growth) while creating others (debt and waste). Despite the spell China casts on the imagination of westerners, there isn’t anything mysterious about it — the misallocation of resources has always been the central problem in the field of economics and no nation has ever been able to solve it, whether through markets, central planning, or a mix of the two.

Maybe one day we will have housing “to each according to his need,” but for now that is not the case — whether you are in China or the US. The two nations have more in common than they think.

For architects, the last decade in China has likely been bittersweet. While there were no shortage of opportunities, architecture is at bottom a practical art, and I imagine the architects who worked on these ghost cities were filled with a sense of emptiness, perhaps even dread, as they contemplated the fate of their creations. A building without a purpose is a melancholy thing indeed, like a song that no one will ever hear.

Architizer is thrilled to announce the winners of the 11th Annual A+Awards! Interested in participating next season? Sign up for key information about the 12th Annual A+Awards, set to launch this fall.

Cover Image: Ordos City, Uday Phalgun, CC BY 2.0